#27 A Pythian Future

What’s new in the Pyth ecosystem? Catch the latest on the Pyth ecosystem: new chains, next steps, new publishers, and new #PoweredByPyth apps!

The Pyth network unlocks valuable financial market data for the general public. The network incentivizes market participants—exchanges, market makers, and trading firms—to share their pricing data directly on-chain. Pyth then aggregates this data on-chain and makes it available for on- and off-chain apps. Read our wiki and whitepaper.

What’s New in the Pyth Ecosystem?

BNB Chain and Binance Sidechains are now #PoweredByPyth

We are delighted to announce that Pyth price feeds are now available on BNB Chain mainnet and Binance Sidechains!

Thanks to the support of Wormhole and Binance, we are proud to enable any BNB native application to leverage Pyth’s high-fidelity data. Any BNB Chain program can now (permissionlessly) request and consume any of Pyth’s 80+ price feeds for equities, commodities, FX, and cryptocurrency directly.

Leading this launch is Venus Protocol, which will be the first #PoweredByPyth BNB Chain application! We are excited to partner with Venus to bring them powerful, high-resolution data to empower their borrow-lending operations.

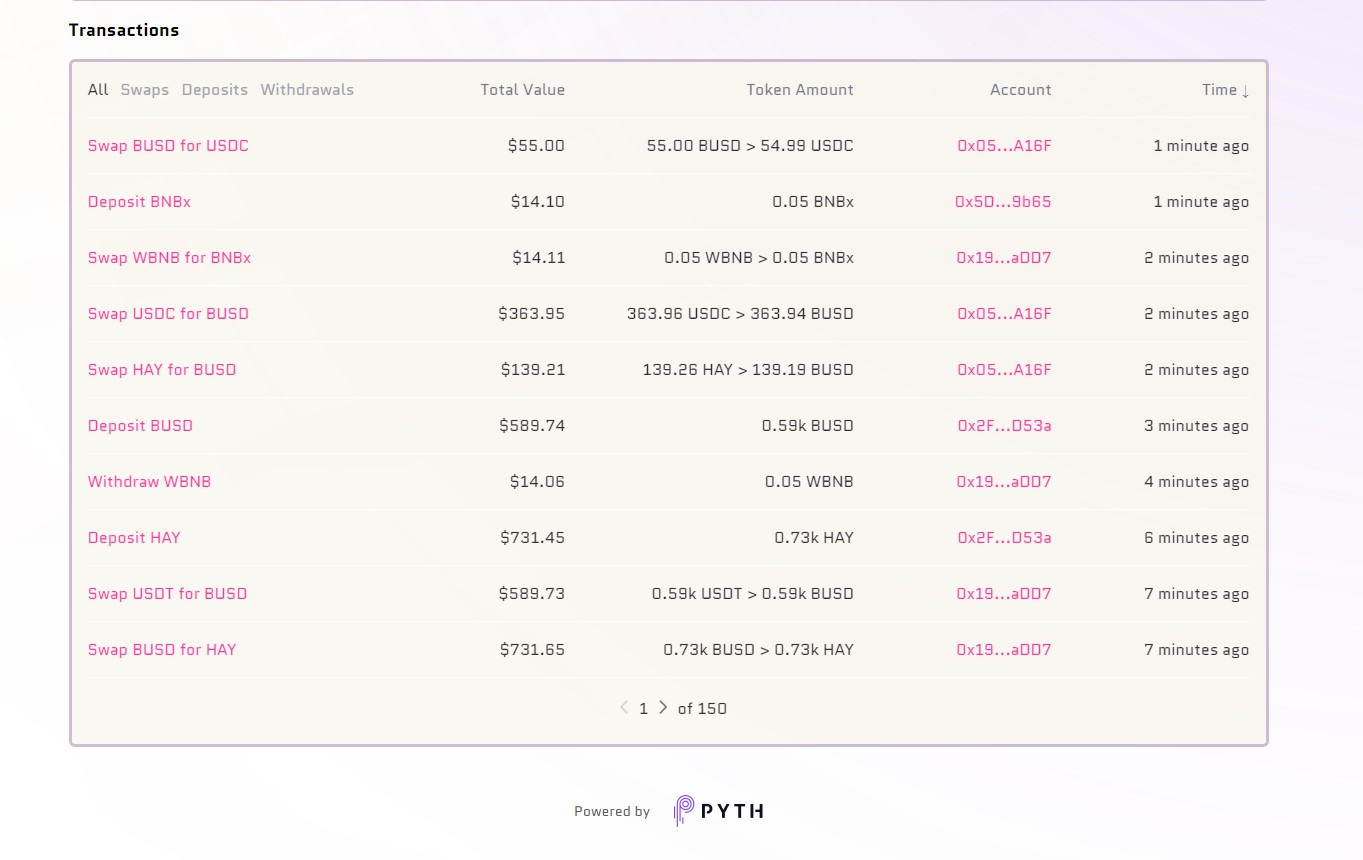

The network also welcomes Wombat Exchange, a leading AMM on BNB Chain. The Wombat Analytics interface enables anyone to easily review the most relevant statistics of the DEX (TVL, Volume, and more) thanks to Pyth data.

If you’re looking to supercharge what you’re building with high-fidelity, low-latency price feeds, be sure to check out the Pyth docs for EVM chains.

Pyth has come a long way since day one. Our goal has always been simple yet ambitious: to make every asset price available on every blockchain. And now, Pyth has been publishing live prices of US equities, FX, metals, and of course, crypto for now over a year.

With over 80 price feeds supported by more than 70 best-in-class data providers across traditional and decentralized finance, we’ve grown considerably since our humble devnet days. And with Pyth now securing $1B+ in TVL and garnering over 550K client downloads, it’s safe to say that developers have taken a liking to what Pyth offers.

So, what’s next?

Pyth data is going cross-chain.

Pyth is now live on mainnet on BNB Chain.

Expect Pyth data to appear on more chains very, very soon.

Up next are all of your favorite L1s and L2s, including Ethereum, Polygon, Injective, NEAR, Avalanche, Fantom, Algorand, Arbitrum, Optimism, Aptos, Sui, and more.

Completing the Network.

The future vision of the Pyth network, as architected in the whitepaper, is one that is self-sustaining and completely decentralized. This new iteration of the Pyth network will consist of a system of mechanisms and incentives coordinating participants in the network. These mechanisms will include data staking, reward distribution, and governance.

You can read more about plans for Pyth’s governance and its relation to Squads:

Vyper Protocol is a DeFi primitive allowing users to create, trade, and settle any kind of on-chain derivatives.

Vyper OTC is the first ever trustless OTC platform allowing you to trade many instruments that were impossible before while remaining completely permissionless and non-custodial. Powered by Pyth, Vyper enables anyone to get exposure to real-life assets with a Pyth price feed.

The first-ever Pyth-related grants have finally found the public light thanks to Superteam!

Superteam is a team of athletes who value the sovereignty that comes with founding a company, the skin in the game that comes with investing, and the joy of getting sh*t done.

This grant project has a dual focus. First, funding developers building dApps, integrations, developer tooling, tutorials for other devs, or other technical contributions. Secondly, funding community builders and organizers who can create content, host events, workshops, etc.

Find more details on the Superteam website.

There’s been a lot of noise around the Mango Markets incident. First of all, our hearts go out to the Mango and wider Solana community. We’ve been long-time partners, and we will continue to support the Mango community as they work through this difficult time.

Secondly, Mango specifically does not use the Pyth network for its $MNGO pricing. This Dune query shows every Solana program that has used the MNGO/USD price feed in the last 30 days: https://dune.com/queries/1390919

Any questions about this topic? Reach out to us on Discord or Telegram.

…

That’s the scoops on the Pyth network this fortnight.

What’s Happening on the Publisher Side?

The network now has reached 75 core contributors, comprising the top trading firms, exchanges, and crypto companies globally.

As the network continues to scale and demand increases, so does our mission to add more high-quality publishers. More data publishers mean even more support for all of your favorite asset prices on-chain, as well as increasing the scope of assets supported.

The Walled Garden (of Data) has Opened-up

One of the largest regulated TradFi exchanges is now dipping their toes into DeFi via the Pyth network. This is beyond groundbreaking.

Cboe Global Markets is a leading provider of market infrastructure and tradable products that delivers cutting-edge trading, clearing, and investment solutions to market participants worldwide. Cboe provides trading solutions and products in multiple asset classes, including equities, derivatives, and FX, across North America, Europe, and Asia Pacific. This is just the beginning.

“We believe DeFi has the potential to play an important role in defining the future of our financial markets, and we are excited to help support its growth through innovative initiatives like the Pyth network,” said Catherine Clay, Executive Vice President, Data and Access Solutions at Cboe Global Markets. “As Cboe establishes its presence deeper in the digital asset space, we look forward to bringing the data solutions from our deep and liquid markets to the global DeFi community and working with our industry peers to transform the digital asset ecosystem and strengthen how financial data is used on the blockchain.”

Killing the Data Monopoly with Orca

Orca is a leading Automated Market Maker (AMM) on Solana. Over the last month, more than $500M of trading volume was exchanged on Orca. Since its inception, Orca has handled over $30B of trading volume. Orca’s highest daily volume was achieved in April 2022, with close to $450M volume traded.

“Joining forces with Pyth offers developers in the Solana ecosystem access to the digital data marketplace we all need. It unlocks access to institutional-grade, high-fidelity financial data for any application on any blockchain,” said Orca’s co-founder Ori Kwan.

OKX is the second biggest global crypto exchange by trading volume and a leading web3 ecosystem. Trusted by more than 20 million global customers, OKX is known for being the fastest and most reliable crypto trading app for investors and professional traders everywhere. In 2021, OKX processed more than 25 billion trades, while trading volumes reached over $21 trillion. OKX traders saw 220 new pairs listed across all markets in the year

Lennix Lai, OKX Director of Financial Markets said: “Given the recent liquidation events in DeFi, we understand that a high-performance, robust, and low-latency market data oracle service is crucial in developing financial products in DeFi. The Pyth network, with sub-second latency and its rapidly growing network of highly respected data partners, is an example of this exciting potential.”

We can’t wait to hear what you think! You can join the Pyth Discord and Telegram, follow us on Twitter, and be the first to hear about what’s new in the Pyth ecosystem through our newsletter. You can also learn more about Pyth here.