A November to Remember (#30)

What’s happening in the Pyth ecosystem? Catch the latest developments here on all things Pyth, including new chains, new publishers, and new #PoweredByPyth apps!

The Pyth network unlocks valuable financial market data for DeFi and the world. The network incentivizes market participants—exchanges, market makers, and trading firms—to share their pricing data directly on-chain. Pyth then aggregates this data on-chain and makes it available for on-chain and off-chain apps. Read our wiki and whitepaper

What’s New in the Pyth Ecosystem?

We’re excited to announce that Pyth is now live on Aurora, the EVM environment built on Near. Thanks to the support of Wormhole and many community contributors, we’re proud to empower builders on Aurora. Programs deployed there can permissionlessly request and directly consume any of Pyth’s 100+ price feeds for equities, metals, foreign exchange pairs, and cryptocurrency.

“The integration of Pyth to Aurora is an extra step toward our ultimate goal of providing DEVs with the best building experience,” said Anton Paisov, head of integrations at Aurora Labs. “With over 75 data providers, we think Pyth will bring a lot of possibilities to the DEVs of our growing ecosystem — and we can’t wait to see the future creations that what will come out of this integration.”

It didn’t take long to see the first Aurora application tapping into Pyth data!

Aurigami is a decentralized, non-custodial liquidity protocol enabling users to lend, borrow, and earn interest with their digital assets. Aurigami leverages the Pyth price feeds to value the assets the program supports and ensure that both the users’ and the protocol remain healthy.

As of today, Aurigami has already made over 6,000 on-demand price updates on Aurora through the Wormhole Network and the Pyth on-chain contract.

Pyth Expands Support for US Equities!

The Pyth network was built to empower builders across Web3 by providing access to previously inaccessible financial market data.

Today marks an important milestone for the Pyth mission: 30 of the biggest US equities have been added to the network. Pyth now supports live price feeds for 39 US equities — the first time this kind of live data has been made freely accessible — with many more to come. This is what it means to bridge the worlds of DeFi and TradFi.

You’re witnessing history in the making as Pyth reshapes how market data is sourced, aggregated, and distributed. Power users are already leveraging this liberated data:

SHIFT empowers traders with a “front page view” of financial markets by providing directional information on daily market movements, volatility, and major trades, all within a sophisticated yet intuitive user experience. By incorporating Pyth feeds directly onto the platform, users can easily compare live exchange pricing with first-party data sources that comprise the Pyth aggregate price.

“More companies with real-time prices provided by Pyth is something we are so proud to be associated with,” said Saad Hussain, founder and CEO at Vesica Technologies. “Again, this is helping the end user with an understanding of the market. And it starts with data.”

OpenBB is the leading open-source investment research platform. Through its open core, developers across the globe can contribute to the project and help democratize investment research.

OpenBB can aggregate asset class data (e.g., stocks, ETF, forex, crypto, futures, etc) and provides advanced machine learning features to help users make sense of this data. By leveraging the Pyth price feeds, the OpenBB terminal can provide live pricing (including equities, metals, FX, and crypto) to users.

“We love working with data sources. Our goal is not to own the data ourselves but to build a platform that enables data sources to share their data with millions of users. This is why our platform is open source,” said Didier Lopes, Co-Founder, and CEO of OpenBB. “Pyth allows us to go one step further and provide live price data, which is something that our users have asked us several times, and only now we can. I’m personally very excited about this since one of our values is transparency, and Pyth is fighting for that in the financial markets.”

What’s Happening on the Publisher Side?

ChilizX joins the Pyth network on time for the World Cup!

We’re delighted to welcome ChilizX, the world’s first tokenized sports exchange created for the Chiliz ecosystem and Socios.com, to the network. ChilizX will contribute its exchange market data for Fan Tokens directly to Pyth.

“We are incredibly excited to partner with the Pyth Network to integrate with ChilizX, to deliver a decentralized, cross-chain market of verifiable data for Fan Tokens,” said Joe Grech, Head of Crypto at Chiliz.

On par with ChilizX's arrival, the Pyth network started releasing price feeds for Chiliz-related Fan Tokens, with many more to come.

As of today, applications can tap into Pyth feeds for: ACM (AC Milan), ARG (Argentina National Team), ASR (AS Roma), ATM (Atletico Madrid), BAR (Barcelona), CHZ (Chiliz), CITY (Manchester City), GAL (Galatasaray), INTER (Inter Milan), ITA (Italian National team), JUV (Juventus), PSG (Paris Saint-Germain), and POR (Portugal National Team).

DWF Labs embark on the Pythian journey!

We are excited to welcome DWF Labs, a global digital asset market maker and multi-stage web3 investment firm, to the network. DWF Labs will both contribute its proprietary market data for digital assets to Pyth and leverage the Pyth price feeds.

“As one of the world’s top crypto high-frequency traders, we can access extremely valuable data that the whole industry can benefit from,” said Andrei Grachev, the Managing Partner of DWF Labs. “By supplying our trading and pricing data to the Pyth Network, and at the same time by integrating their data in our existing workflows, we are making the web3 industry more resilient.”

“More data for everyone means greater transparency, improved scalability, and enhanced reliability for the web3 community as a whole,” commented Lingling Jiang, Head of Regional Sales in the Liquid Markets division of DWF Labs.

Pyth Publisher Series #3 with D2X

In this discussion, we hear from Theodore Rozencwajg at D2X, the soon-to-be-regulated (EU MTF License currently under application) pan-European digital derivatives exchange, and Stephen Kaminsky at Jump Crypto. D2X joined the network earlier this year in September.

What inspired them to join the Pyth network and to contribute to their data? What do they envision for the future of blockchain and decentralized finance? Theodore provides a thoughtful and positive outlook.

What’s New with the Pythians?

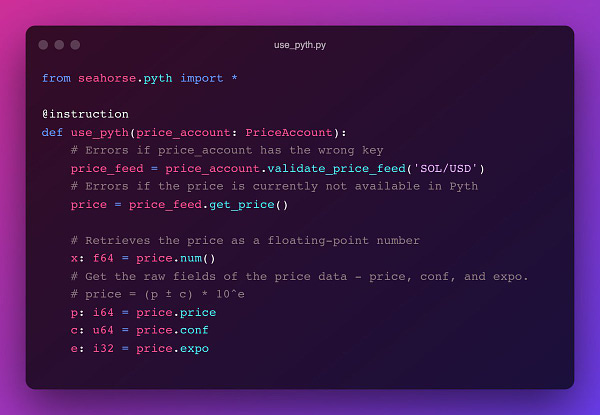

Seahorse Lang turning Pyth into Python

Pyth open-source code symbolizes the crypto motto “Don’t trust, verify”. Anyone can contribute to the Pyth source code and help expand the network’s capabilities.

This month, Seahorse Lang released a native Pyth price feeds integration when developing on Solana using Python. Seahorse Lang is a community-led project which lets developers write Solana programs in Python. This is what empowerment looks like!

We can’t wait to hear what you think! You can join the Pyth Discord and Telegram, follow us on Twitter, and be the first to hear about what’s new in the Pyth ecosystem through our newsletter. You can also learn more about Pyth here.