#2 Who's involved with the Pyth network?

Welcome to this 2nd issue of the Pyth substack: HiFi for DeFi. Today's blog focuses on who do we have onboarded as data publishers and why, followed by a few examples of a Pyth data consumer.

About:

The Pyth network is a vision coming to life: one that imagines the world of decentralized finance (DeFi) gaining comprehensive access to high-fidelity (HiFi) financial markets data securely and reliably.

In other words, the Pyth network is a specialized oracle network that focuses on sourcing continuous real-world and crypto-related market data originating off-chain and streaming it at sub-second speeds for smart contract consumption regardless of their blockchains.

This is an ambitious goal because financial market data is sufficiently unique: there are very few available sources, and those sources have very tightly controlled distributions. In addition, the oracle network needs to be able to combine such latency-sensitive data in way that optimizes not only accuracy but which increases security as well given how dependent many blockchain applications are on the accuracy of this type of data.

REMINDER: Data shown on the website is currently sourced from the Solana testnet & devnet and so should be seen as a demonstration only as prices may not reflect real-world data.

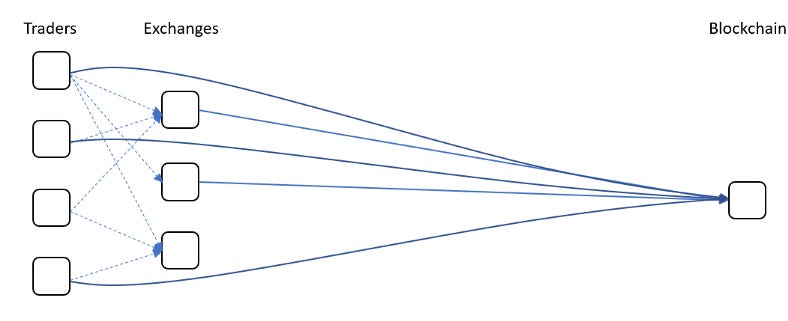

Data being the foundation of any oracle solution, the Pyth network has thus given a significant importance to only source high quality data and establish a direct bridge — without any middlemen — in between the data source and the network or blockchain.

The network has already onboarded many (with more to come) actors that generate troves of 'proprietary' data but for whom data distribution has not been part of their business. More than solely data, onboarded publishers will have the technological capabilities as well as incentives to continuously disseminate accurate market data on-chain.

By doing so, the network found a new and cheaper way to source data as well as removing any friction between the source and the recipient thus improving both the latency and costs of getting HiFi data on-chain.

In comparison, existing oracle solutions focused on wisdom of crowds to source data or through a traditional data distribution workflow wherein data may be delayed or not sourced from where the best market data happens to be. In addition, you often find a middleman in between the data source used and the blockchain further slowing down the update process.

But who are those data providers part of the network?

As of today, the Pyth network has welcomed 16 data providers, ranging from US accredited exchanges, crypto exchanges to worldwide financial services providers and we look to continue expanding this roster of amazing market participants (1 asset feed may receive up to 32 different inputs).

Founded in Chicago 2011 with a focus on options market making using its proprietary technology

Akuna has been trading crypto currency since 2017 with teams trading spot, futures and options

Bitso is the largest cryptocurrency exchange in Latin America with now regular daily traded volume surpassing $10 million

Founded in 2014, Bitso has now welcomed more than 2.5 million users — with half of them onboarded only during the last year!

The Bermuda Stock Exchange (BSX) is the world’s preeminent, fully-electronic, offshore securities exchange, offering domestic and international issuers an affordable, well-regulated listing venue

The BSX is wholly owned by Miami International Holdings (MIH)

CMS is a principal investment firm that operates in the cryptocurrency space.

As a principal investment firm, CMS is both an investor and heavy user on many of the crypto ecosystem’s leading centralized and decentralized venues

CoinShares is Europe’s largest digital asset investment firm, managing approximately 3 billions dollars.

CoinShares Group offered the 1st regulated Bitcoin hedge fund, 1st exchange-traded Bitcoin product, 1st private fund denominated in Ether as well as the 1st exchange-traded Ether product

The Chicago Trading Company (CTC)

Leading provider of liquidity and pricing on derivatives exchanges around the world

Recognized leading provider of liquidity and pricing on derivatives exchanges around the world, trades more than 20 hours a day, six days a week.

Since 2014, Cumberland is a specialized crypto asset trading company within DRW, a well-established and diversified principal trading firm that has 25+ years of experience in traditional markets

Cumberland DRW is one of the founders of the DeFi Alliance in 2020 that aims to bring DeFi to a billion users

Cryptocurrency exchange built by traders, for traders

Offers innovative products, including industry-leading derivatives, options and volatility products, tokenized stocks, prediction markets, leveraged tokens and an OTC desk

Registered broker-dealer and worldwide leader and established partner in over-the-counter digital currency trading

Facilitates billions of dollars on a monthly basis in digital currency trades, loans, and transactions

Designated Market Maker (DMM) on NYSE

Trades approximately 50,000 financial instruments across multiple asset classes globally

IEX Cloud, a cloud based financial data platform introduced in 2019, makes it easy for more people to access and use high-quality financial datasets from across the industry

IEX Cloud is owned by IEX Group (IEX), a financial technology company that also operates the Investors’ Exchange LLC (IEX Exchange), a U.S. securities exchange committed to serving all market participants

Jump Trading Group

Globally-positioned, proprietary trading firm that remains on the cutting edge of algorithmic trading

Active in futures, cryptocurrency, and equities markets globally

KGI Securities (Singapore) is a pioneer Securities & Derivatives, Trading and Clearing Member of Singapore Exchange as well as a pioneer member of ICE Futures Singapore & ICE Clear Singapore

KGI Securities (Singapore) is a market leader in a broad range of areas, including brokerage, proprietary trading, and a variety of derivatives products

Leading operator of institutional execution venues for FX and crypto currency trading

Average daily trading volumes exceed $30 billion (including over $2 billion/day in spot crypto-assets)

Decentralized exchange and ecosystem that brings unprecedented speed and low transaction costs to DeFi

Composable fully on-chain central limit order book

Recognized and listed (NASDAQ) global leader in market making and execution services

Provides liquidity for over 25,000 securities, spread over 235 venues and 50+ countries

XR Trading is a proprietary market-making firm that provides liquidity in a full range of financial instruments across multiple asset classes

With an innovative trading strategy that integrates technology with a quantitative automated market-making approach, XR Trading is a leader in the global derivatives marketplace

Publishers are not required to provide data on all asset class feeds available on Pyth, but rather focus on their individual strengths and access to 1st party data.

For further details on the market data provided by each provider, you may refer to each individual announcement linked above ; you may also explore further with our medium blog on Financial Market Data.

Sourcing and sending data to the blockchain is only the 1st step of this brand new network coming to life, with many more considerations in between to have — for further context you may refer to the Pyth network ecosystem roles paper — but let's keep them for a future blog and instead focus on another type of network stakeholders: the consumers, and more specifically with a few examples we have seen since the network came to life.

First, who are our consumers?

Strictly speaking, the Pyth network data consumers are the protocols integrating our feeds and retrieving prices and confidence values to operate their dApps.

Zeta Markets — Solana Season Hackathon Winner

Zeta (ζ) is an under-collateralized DeFi options platform, providing liquid derivatives trading to individuals and institutions alike. The Zeta team looks to build the world’s fastest on-chain options pricing and liquidation engines by accessing high-frequency price data on-chain.

More than just leveraging Pyth price feeds, they also demonstrated how the confidence value (a value provided by the provider alongside the price of an asset — see article) can bring more value to your (option) protocols!

TL;DR: The confidence value enables Zeta to provide short-term binary options without having to worry about if the oracle price has a huge candle on the very last second of trading. How?

Zeta’s binary options settle to half their payout for both longs and shorts if the strike is within this uncertainty interval. This allows us to provide tradeable, short-term products whilst preventing the risk of random price disagreements close to expiry!

For further details you can refer to the Zeta twitter thread and Pyth thread.

Solend — Solana Season Hackathon Winner of the DeFi Track

Solend is an algorithmic and decentralized protocol for borrowing and lending which enables users to earn interest on their assets and borrow to leverage their exposure to an asset. Solend aims to unlock leveraged long/short, interest-bearing collateral tokens, isolated lending and credit markets, among other things.

To make all of this work, Solend uses Pyth for their price oracle feeds whenever the asset is supported!

With a very recent launch —August 13th — Solend already received over $3M in deposits and currently has over $1M worth in borrowed assets.

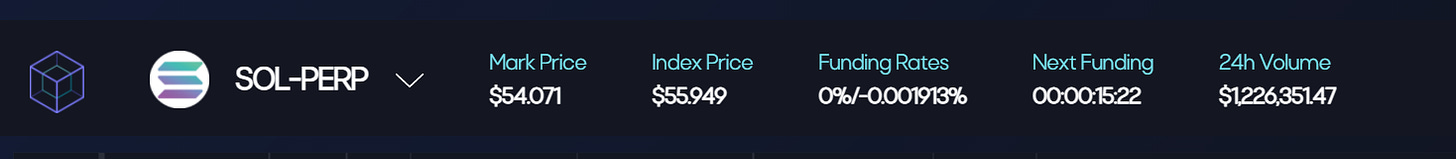

The Audaces Protocol, initially released by Bonfida, has integrated with the Pyth network as its primary oracle solution to power its new vAMM protocol built upon Solana.

We are happy to see Pyth feeds working as market indices to provide both secure and accurate market data to the platform users!

See it live in action here! About $17 million worth have already been traded with the support of Pyth network feeds on $BTC, $ETH and $SOL!

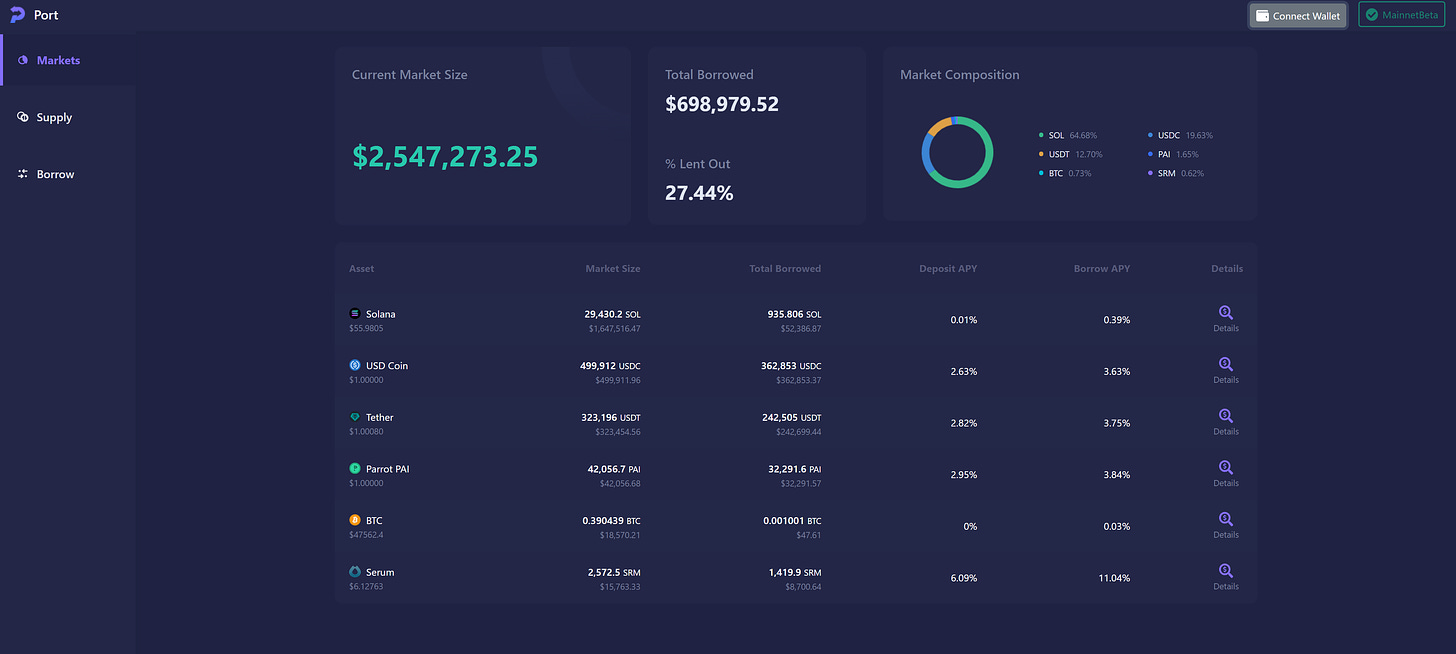

Port Finance is a lending protocol that aims to provide a whole suite of fixed income products including: variable rate lending, fixed rate lending, and interest rate swap ; which went live almost a week from now already. Since, about $2.5M has been provided to the platform with almost $700K in borrowings already.

This is all for our 2nd substack blog - Thank you for reading & don’t forget to subscribe and share!

We can’t wait to hear what you think! Feel free to join the Pyth Discord server, follow Pyth on Twitter,join the Telegram and the Substack or the Medium to learn more and ask any questions you may have.