Your Trades Don't Suck—Your Data Does

Here's a 6-month recap of how Pyth has changed the game for market data in 2025—and what's coming next...

This is a special edition of The Epicenter where Mike Cahill, initial contributor to Pyth Network, takes us all on a deep dive of the first 6 months of 2025. Here, he shares how Pyth is rewriting the market data economy, delivering the price of everything, everywhere. Let’s get into it 👇

Very few people talk about it, but one of the most valuable assets in global finance isn’t capital or even tokenized assets—it’s market data.

This $50B+ industry quietly powers everything from hedge funds and trading desks to retail brokerages and tokenized asset platforms. And yet, the way market data is distributed today is highly fragmented, extremely inaccessibly, and designed to serve only a select few.

That’s why Pyth Network is flipping the script. By employing decentralized infrastructure to distribute first-party, high-fidelity data directly to participants everywhere, Pyth is quickly revolutionizing how market data is produced, shared, and consumed on a global level.

And it’s working. Pyth has grown into the most widely used price layer in DeFi, and now, it’s expanding to meet the needs of traditional financial institutions. From tokenized funds to blockchain-backed banking infrastructure, institutions are no longer sitting on the sidelines. They’re deploying capital and launching products onchain. But they face the same bottleneck DeFi once did: a lack of accessible, reliable, real-time price data.

Pyth is built to serve both sides of the market—the high-performance demands of DeFi and the regulatory precision of on-chain TradFi. In the first half of 2025, the network focused on three key priorities: expanding its price feeds, onboarding real-world assets, and laying the groundwork for long-term monetization. Here’s an in-depth look at what Pyth’s accomplished in the last 6 months—and what’s coming next.

$1.6 trillion later, Pyth is just getting started

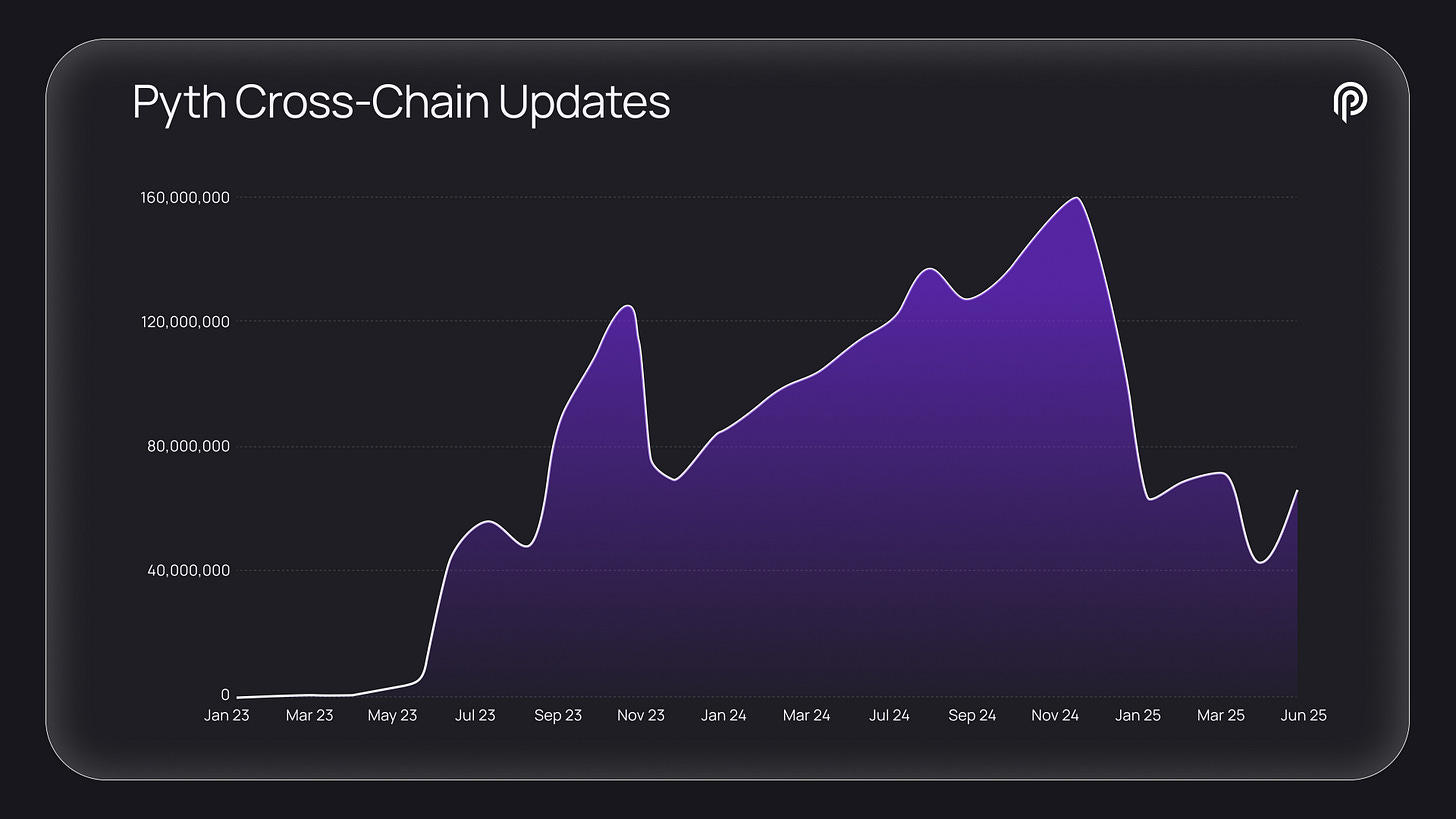

At the beginning of 2025, Pyth had already hit major milestones: $1T in total transaction value, $20B+ in monthly volume, and integrations across 90+ blockchains. But in just six months, every one of those numbers has grown significantly.

As of June 2025, here is where Pyth stands:

$1.6T+ in Total Transaction Value

$75B+ in Monthly TTV

100+ Blockchains integrated

565+ Protocol integrations (15/month, on par with 2024 pace)

1,800+ Price Feeds, including over 900 real-world assets (equities, FX, commodities, and rates)

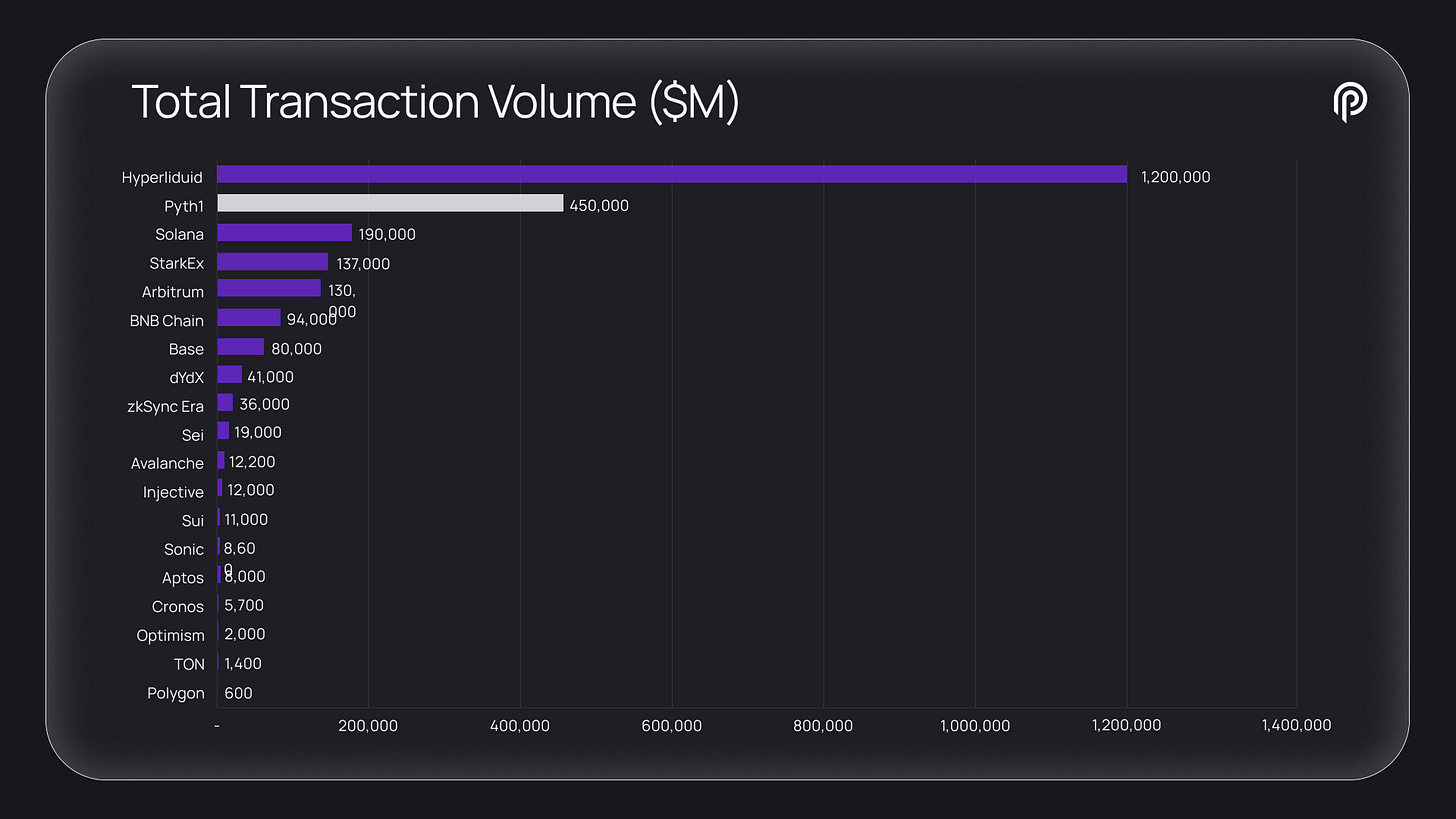

Pyth now processes $50B+ more in monthly TTV than Chainlink—the next closest oracle by volume. And unlike most infrastructure projects, Pyth’s adoption rivals that of major L1s and L2s: the network remains number one by TTV across all ecosystems—a position traditionally reserved for base-layer blockchains.

It’s clear that developers, traders, and protocols aren’t just integrating Pyth—they’re building on it. And that shift from momentum to critical infrastructure is what will set 2025 apart from any other year in Pyth’s journey.

Dominating DeFi’s Core Use Case

As of June 2025, over 60% of all derivatives protocols across DeFi rely on Pyth price feeds. That’s 83 out of 135 total protocols—an industry-leading footprint that has become even more critical as on-chain trading matures.

What’s more is that Pyth continues to outperform most L1s and L2s by key metrics, outpacing both Solana and Sui: to date, Pyth Network enables more cross-chain activity than many so-called base layers and ranks #1 in TTV across all ecosystems.

That’s because the market isn’t just hungry for hype, memecoins, and new chains. Today, the market is hungry for infrastructure that offers real utility to applications and end users. Builders continue to choose Pyth again and again for one simple but significant reason: it performs—and in DeFi, price feeds are more than just inputs; they’re infrastructure.

The Most Integrated Network in DeFi

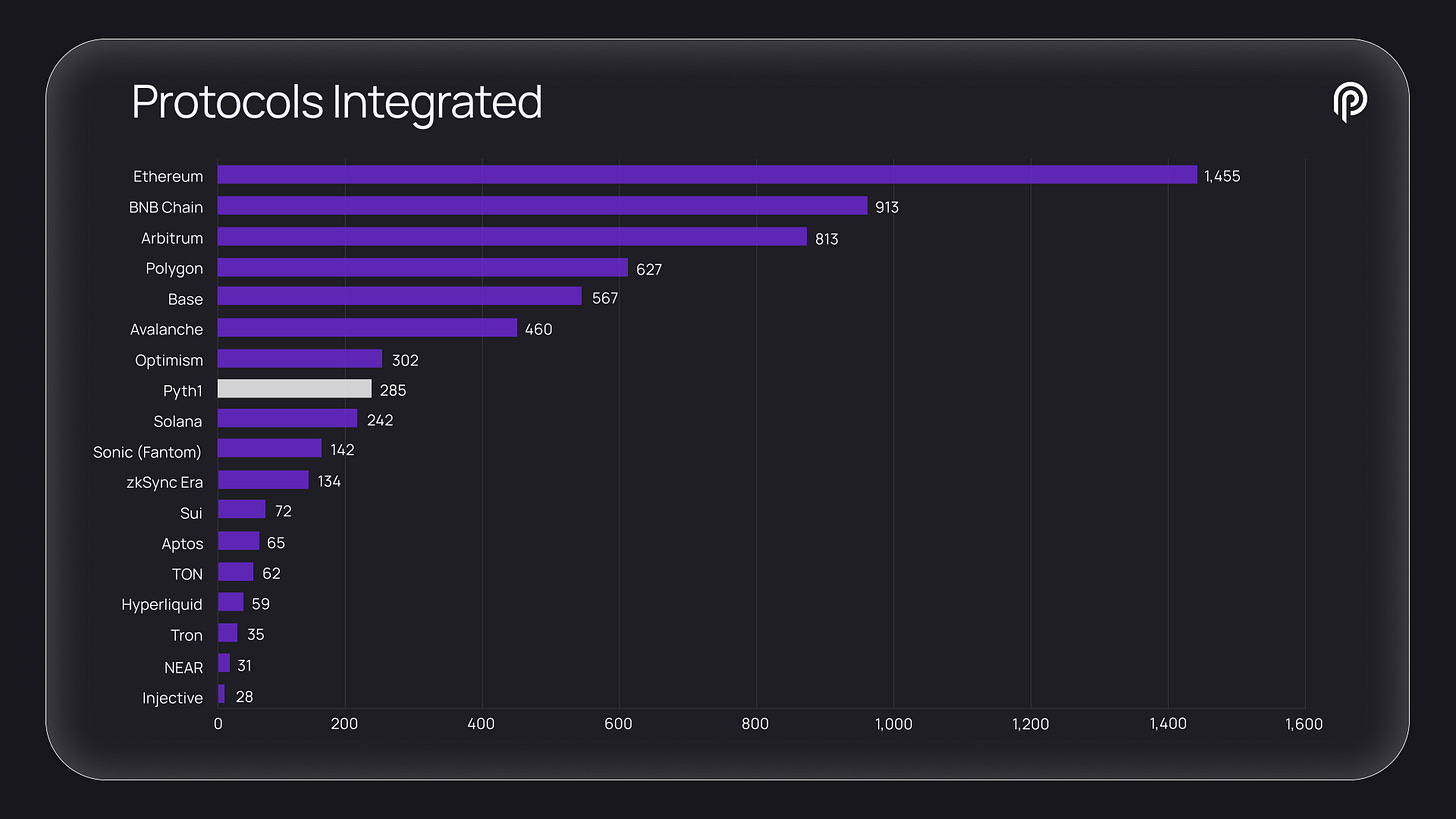

Six months into 2025, Pyth is now integrated with over 100 blockchains and 565+ applications, powering everything from modular L2s to consolidated, high-performance ecosystems.

At the same time, cross-chain activity remains massive, with over 2 million updates daily across every major chain. But what’s changed is how data flows. Instead of blindly pushing updates, we’re seeing more apps pull the specific prices they need, exactly when they need them. That’s what a mature price layer looks like: Pyth powers high-precision data routed by real usage, anytime and anywhere.

Just six months into 2025, Pyth has been embedded in the foundation of the next generation of finance—threading itself through the most critical ecosystems for builders and traders alike.

Staking That Actually Means Something

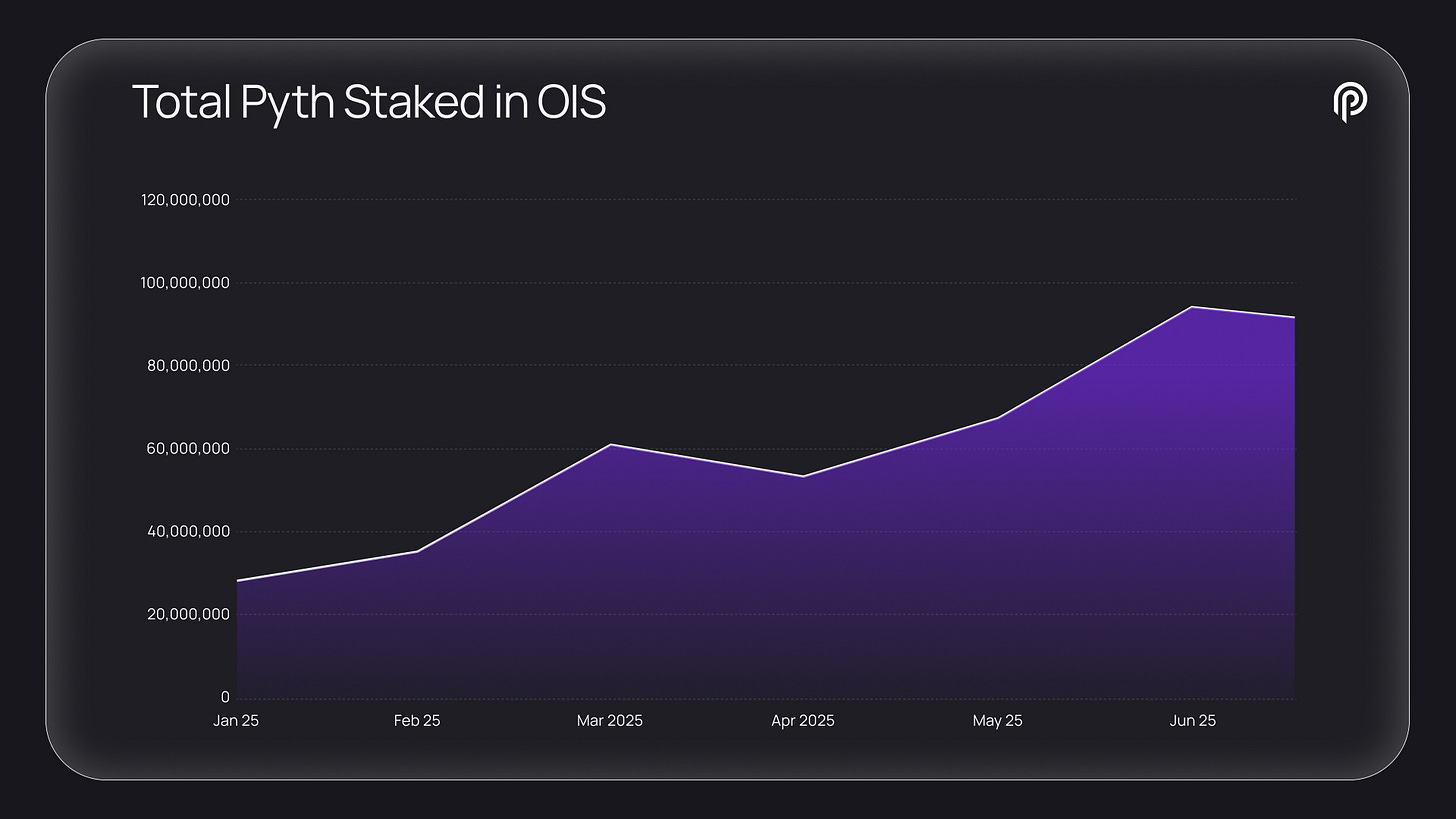

Oracle Integrity Staking (OIS) is also offering something meaningful and different to the ecosystem: it ensures data providers are economically accountable for the prices they publish. As of June 2025, over $100M worth of PYTH tokens are actively staked through OIS—the first and only slashing-enabled oracle staking system in production. This number is significant because it reflects real skin in the game from the network’s most important participants: the publishers themselves.

Why does this matter? Because trust in DeFi doesn’t come from vibes, hype, or a really great narrative. It comes from verifiable incentives, and Pyth is the only price layer holding its data providers to that standard. Through OIS, Pyth shows the entire industry that integrity can be enforced as opposed to just being assumed. This sets a new bar for what decentralized infrastructure should look like.

Access is the New Edge

Early DeFi rewarded breadth. But in 2025, as the modular stack matured and liquidity fragmented across L2s and L3s, the trend reversed: ecosystems began consolidating, and builders started optimizing for performance over novelty.

With 100+ chains and 565+ integrations, Pyth has become the price layer that works the most effectively. It’s fast, reliable, and deeply embedded across the most active ecosystems. While others have focused on speed alone, Pyth brought that same level of discipline to the notion of access—ensuring that the right data is available wherever it’s needed. Today, symbol count has tripled, and Pyth feeds now top TradingView results for assets like TSLA, WTI, and BRENT. Its real-world asset coverage has grown to 900+ feeds, and that’s just the tip of the iceberg.

In its most basic form, Pyth is delivering the right data to the right places at the right time. That’s what the next generation of financial infrastructure looks like, and the first six months of this year have been laying the groundwork to make Pyth available everywhere.

The RWA Moment Is Real

Remember when RWAs were all anyone could talk about in 2021? Well…the early adopters were right—even if their timeline was a little off. Since January, the number of equity users has tripled to 24, and when you include FX, commodities, and rates, that number climbs to 35 active RWA applications.

Pyth is uniquely positioned to lead here. Why? Because it’s one of the only networks capable of distributing first-party, high-fidelity market data on-chain at massive scale.

Pyth has already welcomed Revolut and Sygnum to the network, and the network is in active discussions with nearly every tier-1 financial institution out there.

Bridging the gap between TradFi and DeFi is officially happening—and Pyth is at the center of it all.

Traction You Can’t Fake

Some ecosystems need incentives to grow. Others just build something users actually want.

That’s what we’re seeing with Hyperliquid and HyperEVM. Volume is surging, and it’s being driven by whales as opposed to just really great marketing. Other new ecosystems lighting up the dashboard include Berachain, Sui, Sonic, Base, Unichain, Ink, and BNB Chain, where Aster (formerly ApolloX), is now a top 5 perps DEX by volume, according to DeFiLlama.

This is critical because it shows organic demand for high-performance infra—and it’s all powered by Pyth.

The Price of Everything, Everywhere

Each year, individuals and institutions collectively pay billions for access to market data. But why does this matter?

Ultimately, it signals that price data is the lifeblood powering the financial system as we know it. However, the model for data access that currently exists is deeply broken: it’s fragmented across exchanges, it’s walled off by licensing deals, and at the end of the day, it’s highly inaccessible to the majority of participants. In other words, if you want equities, you have to buy feeds from a dozen different exchanges. If you want a global view of the market, you’ll have to stitch several together to get any kind of insight.

Pyth is turning this model on its head.

By aggregating data directly from exchanges, trading firms, and market makers across digital assets, equities, FX, commodities, and rates, Pyth offers a unified view of global pricing—cross-asset, cross-exchange, and cross-geography. And by including OTC activity, Pyth captures price signals that never touch a public order book.

Today, Pyth publishes 1,800+ real-time price feeds, with 1–2 new datasets added every month and a target of 3,000 by the end of the year. Each feed is instantly available onchain, permissionlessly, and ready to build with. Pyth is also adding 1–2 new datasets every month with a goal of hitting 3,000 feeds by year-end. Each one is made instantly available to anyone who wants access to it.

By rewriting the market data economy, Pyth is directly challenging the system that’s been in place since the dawn of modern finance. That’s because, when everyone has access to the same data, you officially flip the script. For the first time ever, markets are transparent, access is ubiquitous, and any player actually has a shot at winning.

Building the Universal Price Layer

In the first half of 2025, we proved that DeFi’s price layer could scale. Now, the second half is about showing that it can transform markets at a global level by rewriting the market data economy for all of finance.

The network’s next goals are simple but massive:

Expand from 1,800+ to 3,000+ real-time price feeds

Onboard more real-world assets and data providers

Keep optimizing performance as usage scales

Begin laying the groundwork for monetization

The opportunity ahead isn’t theoretical. The price fee market already generates $30B+ annually, and it’s currently only being captured by Bloomberg, Refinitiv, and a handful of legacy gatekeepers. Pyth is uniquely positioned to offer something better: open, programmable access to the price of everything, so everyone can have a seat at the table.

Now more than ever before, the Pyth Network is dedicated to making real-time price data available to anyone with an internet connection. Because even as execution layers evolve and settlement becomes more modular, price is the one constant that markets rely on. That’s why there’s no doubt in my mind that the future of finance will run on Pyth. I can’t wait to see what happens in another 6 months.